About Us

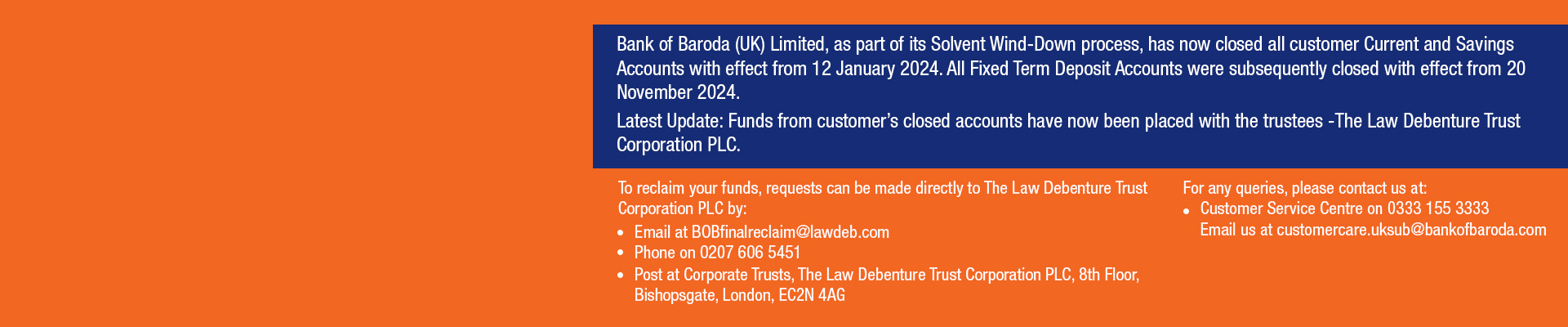

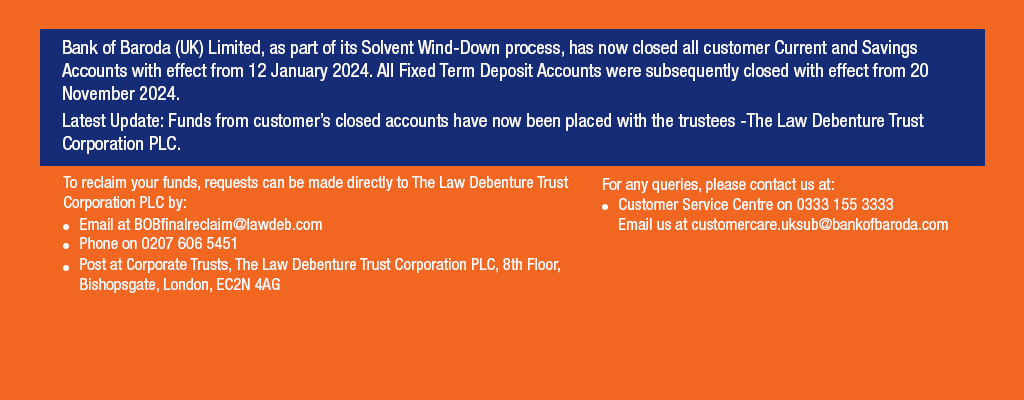

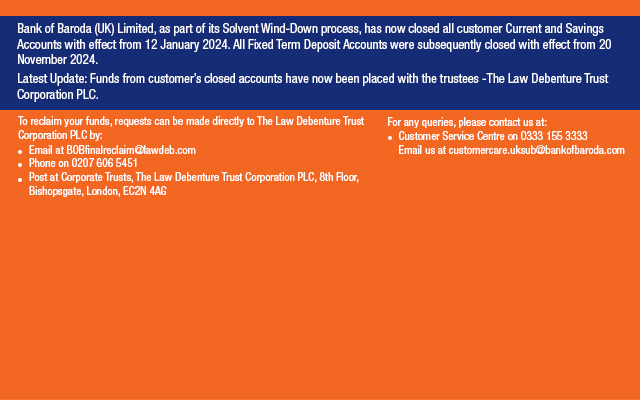

Bank of Baroda (UK) Limited is a wholly-owned subsidiary of Bank of Baroda and registered as a Limited Company in England & Wales. Bank of Baroda (UK) Limited was initially incorporated as Baroda (UK) Operations Limited on 20/06/2017 and subsequently the name was changed to Bank of Baroda (UK) Limited. Bank of Baroda (UK) Limited has commenced it's commercial operations on 17/12/2018 and Bank of Baroda (UK) Limited is authorized by the PRA and regulated by the FCA & PRA in UK.

Bank of Baroda (UK) Limited is having it's registered office at 32, City Road, London EC1 Y 2BD and it is operating in UK through it's -2- branches located in Lmo & Southall

Read MoreProducts

- Personal Banking

- Business

Personal Banking

One-stop solution for all your banking needs, Enjoy various products and services on the go!

- Deposit Products

- Retail Loan

Business

Your business partner for capital needs, Fulfill the goal of your business with us

- Business Loan SME Corporate Loan

- Business Loan (fund-base)

GBP

GBP

INR

INR

USD

USD